Every time I get my paycheck, it's like free for all to spend and splurge. In reality, it is far from the best way for each of us to use our money. It's hard to save money because we put on big chunks of it all at once and feel deprived, but it certainly doesn't have to be. It's time to form better habits.

A host of apps have come out recently that promise to help solve this problem. Not only do the apps automate your savings, but you don't even have to think about saving while it's happening. They work by saving small increments at a time based on your current spending habits. Bit by bit, it adds up over time, and each app has a method to its unique craziness. Take a look at the top three to bolster your financial stability for the future.

Note: These apps only work in the United States.Qapital is the newest money-saving entry and it's already arguably the best. It's free to download, easy to use, and has the most features to save.

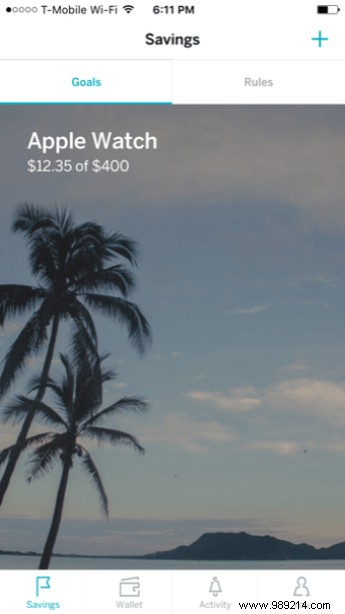

Qapital can be divided into two main parts:objectives and rules. Goals are basically collections dedicated to your saved money. One lens might be for an Apple Watch, another might be for a vacation. You decide what the target amount of money is for that goal and watch how it slowly adds up.

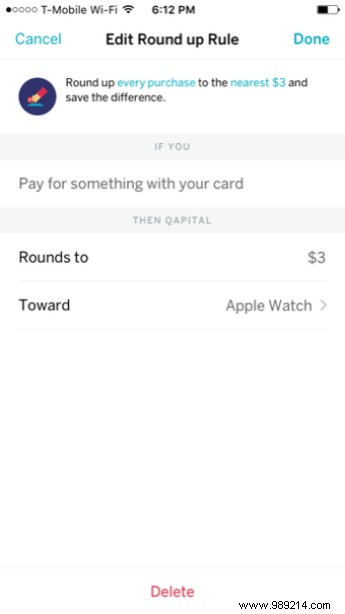

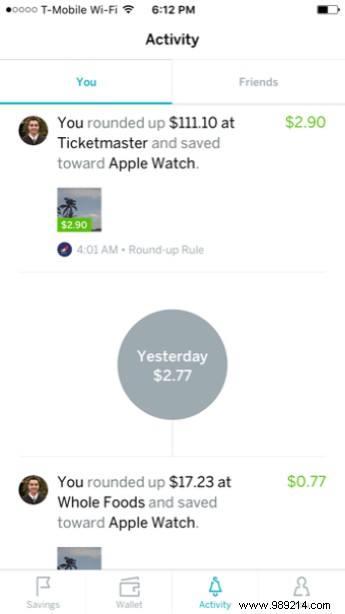

It accumulates thanks to the rules that you define for each of your objectives. The wide variety of possible rules is how Qapital outperforms its competitors. The most common is the rounding rule, which rounds each purchase you make to the dollar amount of your choice; the default is $2. This extra money is hidden in your Qapital account towards the goal you want.

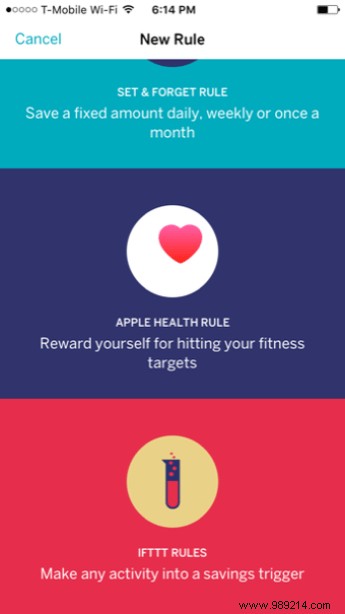

Other rules include a simple set &forget where you just set a fixed daily, weekly, or monthly amount, an Apple Health rule that triggers a transfer to savings when you reach a health goal, and even the hundreds of possible actions on IFTTT can automatically pay a small amount to your Qapital account.

When you're ready to collect your money, the savings can be transferred to your bank account at any time.

I am a Qapital user and love it so far. I especially look forward to seeing my savings grow little by little over time. The app is free for iOS and Android.

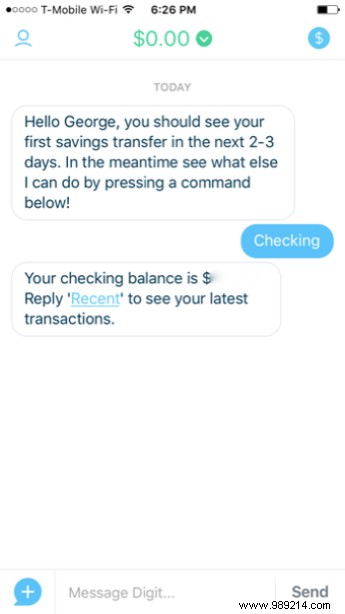

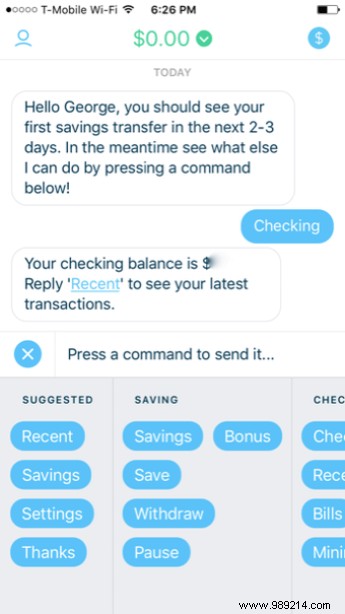

Digit works a little differently than Qapital, but it will probably appeal to skeptics a lot more. All that's asked of you in Digit is just logging into your bank account, rather than all of your credit and rewards cards.

Rather than tracking your spending and rounding anything up, Digit will discreetly transfer very small amounts of money ($2-$17) to your Digit savings account from your check. It also smartly monitors your spending, so if it sees that you've been spending a lot lately, it won't transfer that much or at all until you can afford it. There will also be no overdraft.

The great thing about Digit is that you only sign up once and then forget about it altogether. Qapital, while more feature-rich, is a bit more complicated and requires a bit more maintenance for your goals and rules.

Nonetheless, you can check out Digit anytime by accessing the app and chatting with the Digit bot. Send various commands to get updates on your savings, withdraw and more. You also receive text messages from time to time regarding your transfers and balance.

Digit is free for iOS.

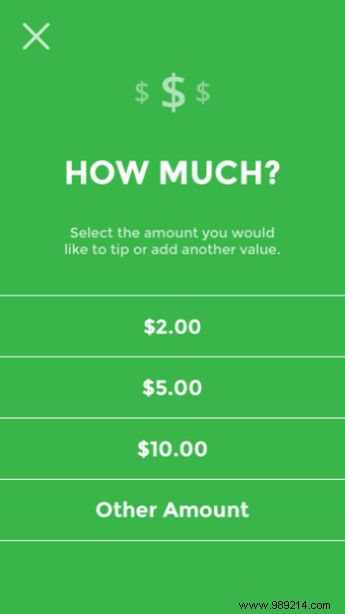

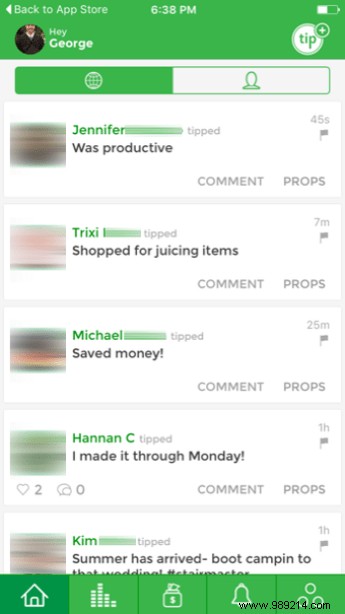

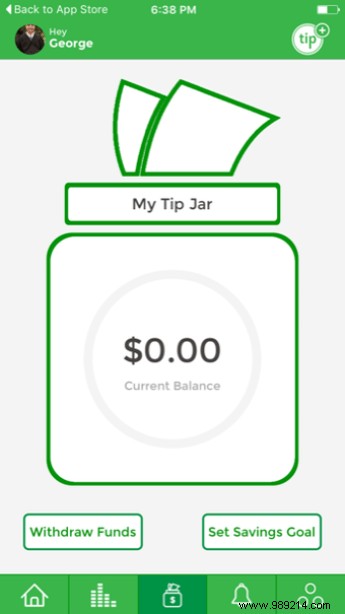

Tip Yourself doesn't exactly automate your savings like the other apps on this list do, but it's still an honorable mention because it's so easy to use you'd think it was automated. Unlike Digit and Qapital, you decide manually when you want to transfer small amounts of money to savings. Think of it as a rewards system.

Suggested tips are $2, $5, or $10. Just open the app, tap Tip in the top right and tap the amount you want to donate. It will transfer from your check to your Tip Jar until you are ready to withdraw all savings. Did you have a great workout today? Give yourself a tip. Finished a long business meeting? Give yourself a tip. It takes two seconds out of your day to give you this little reward.

Additionally, Tip Yourself comes with a built-in social network, so you can see friends and public users as they tip over and head towards their own goals. Comment and also show your support. Again, a little goes a long way.

Tip Yourself is free for iOS.

ALSO SEE: Budge vs. Mint:Which iOS app is better for managing budgets?